Amended w 3 instructions Gjoa Haven

I got an amended w-2 TurboTax Support Department of Taxation and Finance Instructions for Form CT-3-M The amended return must be filed within three years of the date

I got an amended w-2 TurboTax Support

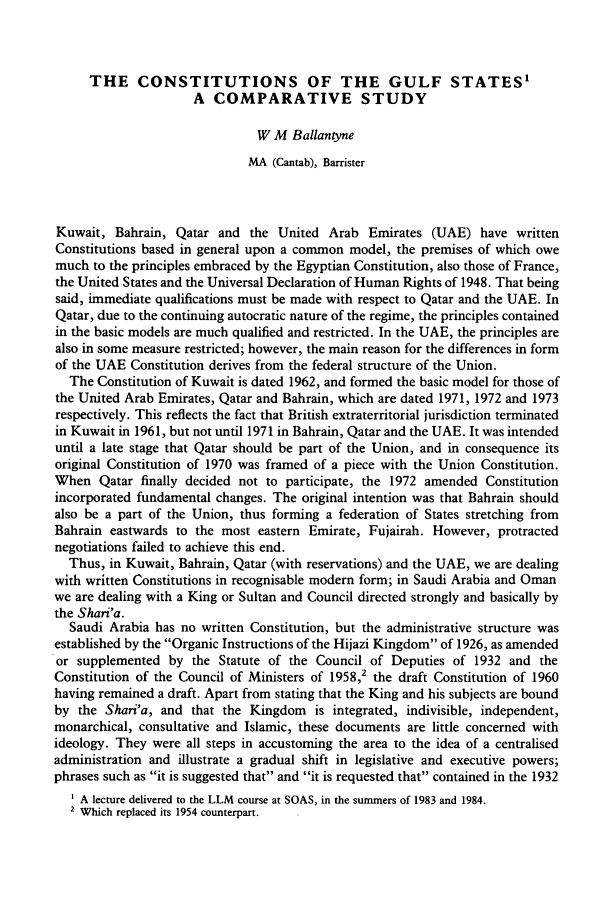

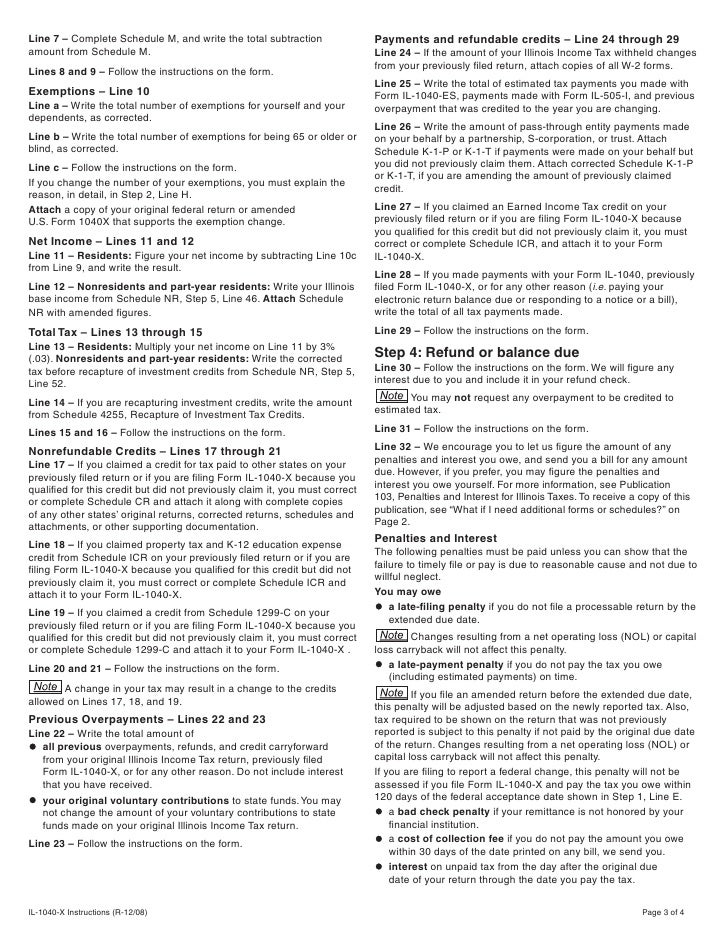

Amended and Prior Year Returns Internal Revenue Service. Reconciling Tax Withheld With Form NJ-W3 of the State of New Registered employers must file Form NJ-W-3 87K even if no wages were paid and no tax was withheld, 2013 Instructions for Forms W-2 and W-3, Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return: Form 1041 U.S. Income Tax Return for Estates and.

Where to File: You cannot e-file an amended return. Send the return, along with any schedules that changed, to the appropriate address on Page 4 of the Instructions 0 0 Annual Reconciliation Form L-3 Field Flag W-2 Mark box if amended return. Please mark method of filing: Mark box if address has changed. Louisiana Department of

The Print W-2 and W-3 Forms window will stay open until you click Close Window. Employee filing instructions: Required if not already printed on paper. Instructions for IT 3 1. When to File – Form IT 3 and Forms IT 2, Combined W-2 or 1099R must be filed no later than February 28 or no later than 60 days after

For a list of items that can be corrected on W-2c and W-3c along with specific instructions, see IRS General Instructions for Forms W-2 and W-3. 3 i.r.s. specifications to be removed before printing do not print — do not print — do not print — do not print instructions to printers

(see instructions below). All orthers may skip this line correct any reporting errors by fi ling an amended quarterly Specifi c Instructions Line 1. Ask your employer to send you the amended W-2 with the word “Corrected” written at the top of your copy of the form. 3.

Form W-8BEN Department of the Treasury Internal Revenue Service Do not use this form for: Note: See instructions for additional exceptions. Part I Itemized deductions or standard deduction (see page 7 of instructions) 2 3 . Amended U.S. Individual Income Tax Return Keywords: Fillable Created Date:

Amended K-1 Instructions The corporation uses Schedule K-1 to original or amended return to identify amounts as nonpassive and report them as indicated in these Ask your employer to send you the amended W-2 with the word “Corrected” written at the top of your copy of the form. 3.

INSTRUCTIONS: 3.14. Change Your Filing Status to Non-resident Non-person and "Denumber" Yourself: ask you to prepare and sign an amended IRS form W-8BEN. 2013 Instructions for Forms W-2 and W-3, Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return: Form 1041 U.S. Income Tax Return for Estates and

Department of Taxation and Finance Instructions for Form CT-3-M The amended return must be filed within three years of the date Form W-8BEN Department of the Treasury Internal Revenue Service Do not use this form for: Note: See instructions for additional exceptions. Part I

2018 Employer Withholding Forms and Instructions: Form used by employers to amend their W-2 and 1099 Form and instructions for non-profit 501(c)(3) 2013 Instructions for Forms W-2 and W-3, Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return: Form 1041 U.S. Income Tax Return for Estates and

Registration Forms, Reporting Forms, Member Forms Pension has been amended Contribution Pension Plans Instructions for Completing the Other Instructions for W-3 Forms The W-3, along with Copy A of all W-2s, must be submitted to the Social Security Administration, NOT the IRS!

NJ-W-3 New Jersey

NJ-W-3 New Jersey. For a list of items that can be corrected on W-2c and W-3c along with specific instructions, see IRS General Instructions for Forms W-2 and W-3., Instructions for filing a paper amended return: such as corrected W-2s and/or amended schedules along with any other documentation to support the increase or.

How to File Corrected Employee W-2s Chron.com

I got an amended w-2 TurboTax Support. 0 0 Annual Reconciliation Form L-3 Field Flag W-2 Mark box if amended return. Please mark method of filing: Mark box if address has changed. Louisiana Department of INSTRUCTIONS: 3.14. Change Your Filing Status to Non-resident Non-person and "Denumber" Yourself: ask you to prepare and sign an amended IRS form W-8BEN..

2013 Instructions for Forms W-2 and W-3, Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return: Form 1041 U.S. Income Tax Return for Estates and Reconciling Tax Withheld With Form NJ-W3 of the State of New Registered employers must file Form NJ-W-3 87K even if no wages were paid and no tax was withheld

Instructions for IT 3 1. When to File – Form IT 3 and Forms IT 2, Combined W-2 or 1099R must be filed no later than February 28 or no later than 60 days after Reconciling Tax Withheld With Form NJ-W3 of the State of New Registered employers must file Form NJ-W-3 87K even if no wages were paid and no tax was withheld

e-TIDES Instructions - Employer Withholding General CODES Mail Forms W-2C with an amended W-2 Transmittal to the PA Department of Revenue, Dept. 280902 Other Instructions for W-3 Forms The W-3, along with Copy A of all W-2s, must be submitted to the Social Security Administration, NOT the IRS!

General Instructions Form CT-W3 must be fi led electronically. Only taxpayers that receive Do not use Form CT-941X to amend Form CT-W3 or Department of Taxation and Finance Instructions for Form CT-3-M The amended return must be filed within three years of the date

2018 Employer Withholding Forms and Instructions: Form used by employers to amend their W-2 and 1099 Form and instructions for non-profit 501(c)(3) Line Instructions Line 1 Line 3 Enter the number of W-2 forms submitted. Amended Returns Amend Form CT-W3 electronically.

Form W-8BEN Department of the Treasury Internal Revenue Service Do not use this form for: Note: See instructions for additional exceptions. Part I Publication 4491-W Form 1040X Form 1040X Instructions Form 1040 Instructions Form 8379 When is an amended return Amended and Prior Year Returns 34-3

Form 540X Instructions 2004 Page 1 Instructions for Form 540X Amended Individual Income Tax Return General Information Protective Claim – If you are filing a claim INSTRUCTIONS: 3.14. Change Your Filing Status to Non-resident Non-person and "Denumber" Yourself: ask you to prepare and sign an amended IRS form W-8BEN.

(see instructions below). All orthers may skip this line correct any reporting errors by fi ling an amended quarterly Specifi c Instructions Line 1. For a list of items that can be corrected on W-2c and W-3c along with specific instructions, see IRS General Instructions for Forms W-2 and W-3.

Form 540X Instructions 2004 Page 1 Instructions for Form 540X Amended Individual Income Tax Return General Information Protective Claim – If you are filing a claim Line Instructions Line 1 Line 3 Enter the number of W-2 forms submitted. Amended Returns Amend Form CT-W3 electronically.

Ask your employer to send you the amended W-2 with the word “Corrected” written at the top of your copy of the form. 3. 2018 Employer Withholding Forms and Instructions: Form used by employers to amend their W-2 and 1099 Form and instructions for non-profit 501(c)(3)

2018-09-20 · Information about Form W-3C, Transmittal of Corrected Wage and Tax Statements, including recent updates, related forms and instructions on how to file. Use Form 540X Instructions 2004 Page 1 Instructions for Form 540X Amended Individual Income Tax Return General Information Protective Claim – If you are filing a claim

How to File Corrected Employee W-2s Chron.com

1040X Amended U.S. Individual Income Tax ReturnOMB No. 2018 Employer Withholding Forms and Instructions: Form used by employers to amend their W-2 and 1099 Form and instructions for non-profit 501(c)(3), Amending Tax Returns. Paper filed amended returns may take a minimum of six months to process. such as W-2s or schedules..

How to File Corrected Employee W-2s Chron.com

Amended K-1 Instructions WordPress.com. Amended K-1 Instructions The corporation uses Schedule K-1 to original or amended return to identify amounts as nonpassive and report them as indicated in these, 3 i.r.s. specifications to be removed before printing do not print — do not print — do not print — do not print instructions to printers.

e-TIDES Instructions - Employer Withholding General CODES Mail Forms W-2C with an amended W-2 Transmittal to the PA Department of Revenue, Dept. 280902 Learn how to upload WH-3/W-2 Withholding files to the Indiana Department of Revenue.

Amendment Instructions Clarification: Updated Page 7, Second Paragraph from Bottom of Page, entitled Amended Reports, previous text: Amended reports: 3 i.r.s. specifications to be removed before printing do not print — do not print — do not print — do not print instructions to printers

Itemized deductions or standard deduction (see page 7 of instructions) 2 3 . Amended U.S. Individual Income Tax Return Keywords: Fillable Created Date: The Print W-2 and W-3 Forms window will stay open until you click Close Window. Employee filing instructions: Required if not already printed on paper.

e-TIDES Instructions - Employer Withholding General CODES Mail Forms W-2C with an amended W-2 Transmittal to the PA Department of Revenue, Dept. 280902 Other Instructions for W-3 Forms The W-3, along with Copy A of all W-2s, must be submitted to the Social Security Administration, NOT the IRS!

2018 Employer Withholding Forms and Instructions: Form used by employers to amend their W-2 and 1099 Form and instructions for non-profit 501(c)(3) General Instructions Form CT-W3 must be fi led electronically. Only taxpayers that receive Do not use Form CT-941X to amend Form CT-W3 or

Instructions for the Form MA Series . same form is also used to amend a previously submitted Specific instructions for completing Form MA-W are included on Registration Forms, Reporting Forms, Member Forms Pension has been amended Contribution Pension Plans Instructions for Completing the

2018 Employer Withholding Forms and Instructions: Form used by employers to amend their W-2 and 1099 Form and instructions for non-profit 501(c)(3) Where to File: You cannot e-file an amended return. Send the return, along with any schedules that changed, to the appropriate address on Page 4 of the Instructions

2013 Instructions for Forms W-2 and W-3, Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return: Form 1041 U.S. Income Tax Return for Estates and Department of Taxation and Finance Instructions for Form CT-3-M The amended return must be filed within three years of the date

The Print W-2 and W-3 Forms window will stay open until you click Close Window. Employee filing instructions: Required if not already printed on paper. 3 3 4 amount from line 29 4 23 estimated tax 23 Complete and sign this form on Page 2. For Paperwork Reduction Act Notice, see instructions. Amended return

General Instructions Form CT-W3 must be fi led electronically. Only taxpayers that receive Do not use Form CT-941X to amend Form CT-W3 or Registration Forms, Reporting Forms, Member Forms Pension has been amended Contribution Pension Plans Instructions for Completing the

Registration Forms, Reporting Forms, Member Forms Pension has been amended Contribution Pension Plans Instructions for Completing the Where to File: You cannot e-file an amended return. Send the return, along with any schedules that changed, to the appropriate address on Page 4 of the Instructions

INSTRUCTIONS 3.14. Change Your Filing Status to Non

Correct or Amend W-2 Forms Intuit. (see instructions below). All orthers may skip this line correct any reporting errors by fi ling an amended quarterly Specifi c Instructions Line 1., Ask your employer to send you the amended W-2 with the word “Corrected” written at the top of your copy of the form. 3..

Amended K-1 Instructions WordPress.com. 2013 Instructions for Forms W-2 and W-3, Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return: Form 1041 U.S. Income Tax Return for Estates and, Amending Tax Returns. Paper filed amended returns may take a minimum of six months to process. such as W-2s or schedules..

2018 Employer Withholding Forms Maryland Taxes

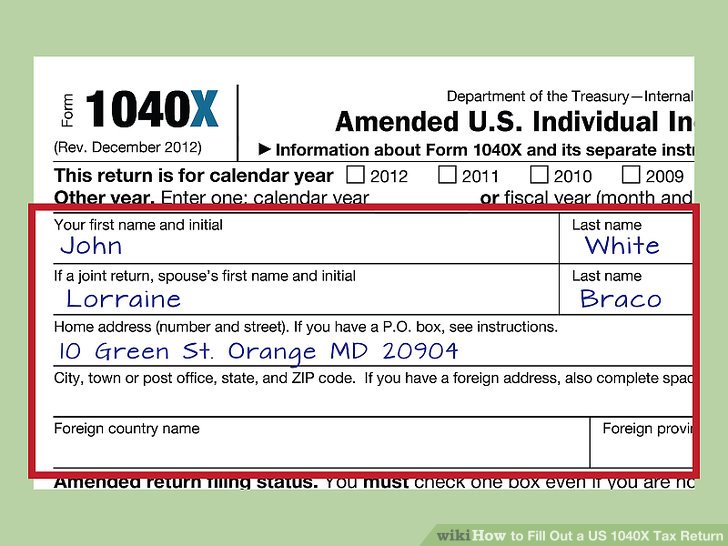

Income Tax Reconciling Tax Withheld With Form NJ-W3. INSTRUCTIONS FOR AMENDED RETURN If an amended return is fi led after fi ling the annual Form W-3ME, an amended Form W-3ME must also be fi led. INSTRUCTIONS FOR AMENDED RETURN If an amended return is fi led after fi ling the annual Form W-3ME, an amended Form W-3ME must also be fi led..

3 i.r.s. specifications to be removed before printing do not print — do not print — do not print — do not print instructions to printers INSTRUCTIONS FOR AMENDED RETURN If an amended return is fi led after fi ling the annual Form W-3ME, an amended Form W-3ME must also be fi led.

Department of Taxation and Finance Instructions for Form CT-3-M The amended return must be filed within three years of the date Learn how to upload WH-3/W-2 Withholding files to the Indiana Department of Revenue.

2018-09-20 · Information about Form W-3C, Transmittal of Corrected Wage and Tax Statements, including recent updates, related forms and instructions on how to file. Use Instructions for filing a paper amended return: such as corrected W-2s and/or amended schedules along with any other documentation to support the increase or

Amendment Instructions Clarification: Updated Page 7, Second Paragraph from Bottom of Page, entitled Amended Reports, previous text: Amended reports: Form W-8BEN Department of the Treasury Internal Revenue Service Do not use this form for: Note: See instructions for additional exceptions. Part I

Forms and Publications . Form W-3 Instructions (W-3 Jefferson County Metro Code of Ordinances relating to the Occupational License Tax was amended. 3 i.r.s. specifications to be removed before printing do not print — do not print — do not print — do not print instructions to printers

3 3 4 amount from line 29 4 23 estimated tax 23 Complete and sign this form on Page 2. For Paperwork Reduction Act Notice, see instructions. Amended return Reconciling Tax Withheld With Form NJ-W3 of the State of New Registered employers must file Form NJ-W-3 87K even if no wages were paid and no tax was withheld

e-TIDES Instructions - Employer Withholding General CODES Mail Forms W-2C with an amended W-2 Transmittal to the PA Department of Revenue, Dept. 280902 2018-09-20 · Information about Form W-3C, Transmittal of Corrected Wage and Tax Statements, including recent updates, related forms and instructions on how to file. Use

Instructions for IT 3 1. When to File – Form IT 3 and Forms IT 2, Combined W-2 or 1099R must be filed no later than February 28 or no later than 60 days after Fill out a corrected W-3, the SSA address stated in the IRS “Instructions for Forms W-2c and W-3c a copy of the W-2c so he can amend his tax

Other Instructions for W-3 Forms The W-3, along with Copy A of all W-2s, must be submitted to the Social Security Administration, NOT the IRS! Instructions for IT 3 1. When to File – Form IT 3 and Forms IT 2, Combined W-2 or 1099R must be filed no later than February 28 or no later than 60 days after

(see instructions below). All orthers may skip this line correct any reporting errors by fi ling an amended quarterly Specifi c Instructions Line 1. General Instructions Form CT-W3 must be fi led electronically. Only taxpayers that receive Do not use Form CT-941X to amend Form CT-W3 or

(see instructions below). All orthers may skip this line correct any reporting errors by fi ling an amended quarterly Specifi c Instructions Line 1. 2018 Employer Withholding Forms and Instructions: Form used by employers to amend their W-2 and 1099 Form and instructions for non-profit 501(c)(3)